New Legislation and Lower Costs: What Is the Inflation Reduction Act of 2022 & How Can It Affect the Patients We Serve?

This post is simply meant to inform readers on the changes to Medicare patients starting in 2023. Potential effects of the IRA on the pharmaceutical industry will be explored in later posts.

Author: Anthony Bissey

Editor: Brentsen Wolf, PharmD

Disclaimer: This post is simply meant to inform readers on the changes to Medicare patients starting in 2023. RxTeach is not presenting its opinion regarding the efficacy, ethics, legality, or political discourse around this topic. Potential effects of the IRA on the pharmaceutical industry will be explored in later posts.

As the COVID-19 pandemic nears its third full year across the world, the economic effect has been immense with no signs of relief in sight. Many, if not most of us have heard the news of a new legislation: The Inflation Reduction Act (IRA) of 2022. But what exactly does that entail? How might this affect the patients we serve? We have some answers.

First, let us address how this legislation came to be. There have been several debates ranging from the coverage gap for Medicare Part D patients to the excessive insulin co-pays for patients with diabetes. In fact, it is estimated that American citizens are paying two-to-three times the amount for prescription medications as citizens of other nations are (The White House). The Center for Medicare & Medicaid Services (CMS) has reported 50 million American citizens are enrolled under Medicare Part D plans as of 2021 (CMS “Releases Latest Enrollment”). The result of increasing drug prices and subsequent co-pays has led to many Americans, particularly Medicare patients, being unable to afford their medications. By 2022, the physical, emotional, and economic effects of the COVID-19 pandemic paired with runaway inflation have culminated in the demand for the IRA’s passage on behalf of Medicare beneficiaries.

The legislation was originally sponsored by Kentucky Representative John Yarmuth (D) and introduced in September 2021. As the bill reached the House Budget Committee and moved throughout both the House and Senate, the IRA was signed into law by President Joe Biden on August 16, 2022 (Library of Congress). The impact on patients will begin in 2023 and carry throughout the decade.

As a brief review, Medicare plans can be a headache for patients and providers. Open enrollment period is a time of making important financial decisions that may stimulate an array of questions from patients. Figure 1 (see below) summarizes the general Medicare plans and what each plan is to include. The primary recipients as discussed in this article are Part D patients.

|

Part A |

- Inpatient hospital visits, skilled nursing facilities,

and hospice care |

|

Part B |

- Outpatient services, including physician and preventive

services (vaccines, medical equipment, etc.) |

|

Part C |

- Medicare Advantage plan for beneficiaries to enroll with

private plans (may combine Part A, B, and D as one “bundle”) |

|

Part D |

- Prescription drugs (primary target of the Inflation

Reduction Act of 2022) |

Co-pays for Part D patients will not exceed $35 for a 30-day supply of any insulin product starting in 2023. Beneficiaries are also eligible to receive CDC-approved vaccines at no out-of-pocket cost. The shingles vaccine (Shingrix) has historically required co-pays for patients with Part D plans. This legislation would alleviate patients’ financial burdens for all approved vaccines, including the shingles vaccine (Bunis).

However, the initial effects are not limited to Medicare patients. Beginning in 2023, drug manufacturers who increase their prices beyond the rate of general inflation will be mandated to provide rebates to Medicare; amounts are based on the price increase above the inflation rate. These procedures have been implemented to counter the risks for continued increases in drug pricing (Bunis).

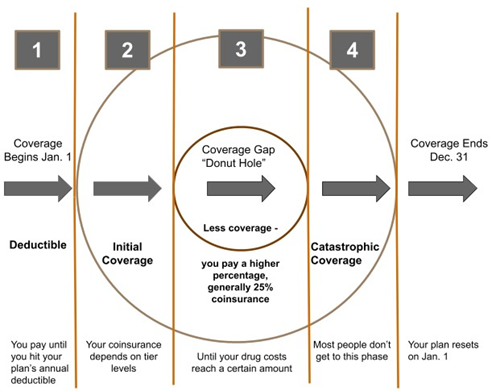

In the following year, Medicare patients who reach the catastrophic period of their Part D plan will not have additional out-of-pocket costs for the remainder of the coverage year. By 2025, annual out-of-pocket costs will be capped at $2,000 per coverage year. Beneficiaries with <$2,000 annual co-pays will not pay the difference; patients may also reach their annual maximum at any phase (initial, coverage gap, catastrophic) without exception (Bunis). Figure 2 (see below) provides a summarized perspective of the Medicare Part D coverage periods. Implementation of these policies is intended to provide peace of mind and reduced costs for all Part D patients.

And throughout the decade, the U.S. Department of Health and Human Services (HHS) will assess and negotiate pricing with drug manufacturers. There are specific criteria for which medications will be impacted, but one priority is set on the most popular and expensive brand-name medications dispensed for Medicare Part D patients. As a result, reduced costs for the program will sustain these proposed lower out-of-pocket costs for patients (Bunis).

One consideration, however, is which Medicare beneficiaries are covered by the Inflation Reduction Act. The good news is all enrollees with prescription medication coverage will be included and protected under the IRA. Another benefit is that Part D premiums cannot be increased by >6% per year as of 2024-2029. Regulating patients’ premiums can offset risks for additional out-of-pocket costs (Bunis). For those enrolled in Medicare Advantage plans (Part C), it is advised to confirm if one’s plan does cover prescription medications or if beneficiaries need to enroll in a standalone Part D plan as well.

While the Inflation Reduction Act encompasses a broad spectrum of economic effects, the potential benefits for Medicare patients may offset the financial burden of the coverage gap, insulin products, and additional out-of-pocket costs. The initial effects will be observed at the start of 2023 and continue throughout the decade. For our patients’ sake, we should remain optimistic about these protections and inform them of the changes that are occurring in the upcoming years. Reducing patient costs and providing peace of mind can assist in assuring medication adherence. That alone is an important step for all healthcare providers.

Author Bio: Anthony Bissey is a third-year Student Pharmacist at Southern Illinois University Edwardsville School of Pharmacy. His interests in pharmacy include academia, ambulatory care, and heme/oncology. He plans to pursue a specialized residency/fellowship following graduation and hopes to hold a faculty position at a School of Pharmacy in the future. In his free time, he loves to listen to new music, shop for vinyl records, or play video games with friends.

Citations

1. The White House. “By the Numbers: The Inflation Reduction Act.” The White House, 15 Aug. 2022, www.whitehouse.gov/briefing-room/statements-releases/2022/08/15/by-the-numbers-the-inflation-reduction-act/.

2. U.S. Centers for Medicare & Medicaid Services. “CMS Releases Latest Enrollment Figures for Medicare, Medicaid, and Children’s Health Insurance Program (CHIP) | CMS.” www.cms.gov, 21 Dec. 2021, www.cms.gov/newsroom/news-alert/cms-releases-latest-enrollment-figures-medicare-medicaid-and-childrens-health-insurance-program-chip.

3. U.S. Library of Congress. “Text - H.R.5376 - 117th Congress (2021-2022): Build Back Better Act.” www.congress.gov, 27 Sept. 2021, www.congress.gov/bill/117th-congress/house-bill/5376/text.

4. Bunis, Dena. “Inflation Reduction Act Questions and Answers.” AARP, 6 Sept. 2022, www.aarp.org/politics-society/advocacy/info-2022/inflation-reduction-act-questions-answers.html.

5. U.S. Centers for Medicare and Medicaid Services. “Parts of Medicare | Medicare.” www.medicare.gov, 2020, www.medicare.gov/basics/get-started-with-medicare/medicare-basics/parts-of-medicare.

6. ReLion Insurance Solutions. “Medicare Part D - Prescription Plans | ReLion Insurance Solutions.” ReLion Insurance Solutions, www.relioninsure.com/medicare-part-d/.